When you trade SATOS, a cryptocurrency token often traded on decentralized and altcoin-focused exchanges, the price isn’t the only thing that matters. Your trading fees, the charges exchanges apply every time you buy or sell can eat into your gains faster than you think. Even if SATOS drops 1% and you think you broke even, you might actually be down 2% after fees. It’s not magic—it’s math. And most traders don’t check the fine print until it’s too late.

Not all exchanges charge the same. Some, like CoinEx, a platform known for low fees and deep altcoin markets, list their fees clearly: 0.1% per trade, sometimes lower for high-volume users. Others hide fees in spreads, withdrawal charges, or maker-taker structures you won’t notice until your order doesn’t fill. And then there are platforms like Uzyth or UEX—where trust is thin, fees are unclear, and security is questionable. If you’re trading SATOS or any altcoin, you need to know who’s charging what, and why. Fee structures aren’t just numbers—they’re signals. Low fees often mean more liquidity. Hidden fees often mean less transparency.

It’s not just about the trade fee either. What about depositing? Withdrawing? Using a chain like Solana or Polygon? If SATOS is on Solana, you might pay 0.0001 SOL in network fees—barely a penny. But if it’s on an obscure chain with poor tooling, you could end up paying $5 in gas just to move it. And don’t forget: some exchanges charge extra for fiat on-ramps, or lock you into high fees if you use their native token for discounts. The real cost of trading SATOS isn’t just the price you see. It’s the sum of every hidden charge, every slow withdrawal, every failed trade because the fee was too low.

You’ll find posts here that break down exactly how platforms like CoinEx, Bitfinex, and even sketchy ones like Uzyth handle fees. Some have transparent fee schedules. Others? They don’t even list them. You’ll also see how liquidity affects your actual cost—low volume means wider spreads, which means you pay more even if the fee is 0%. We’ve dug into exchange reviews, fee tables, and user reports so you don’t have to guess. This isn’t about finding the cheapest exchange. It’s about finding the one that doesn’t quietly steal from you.

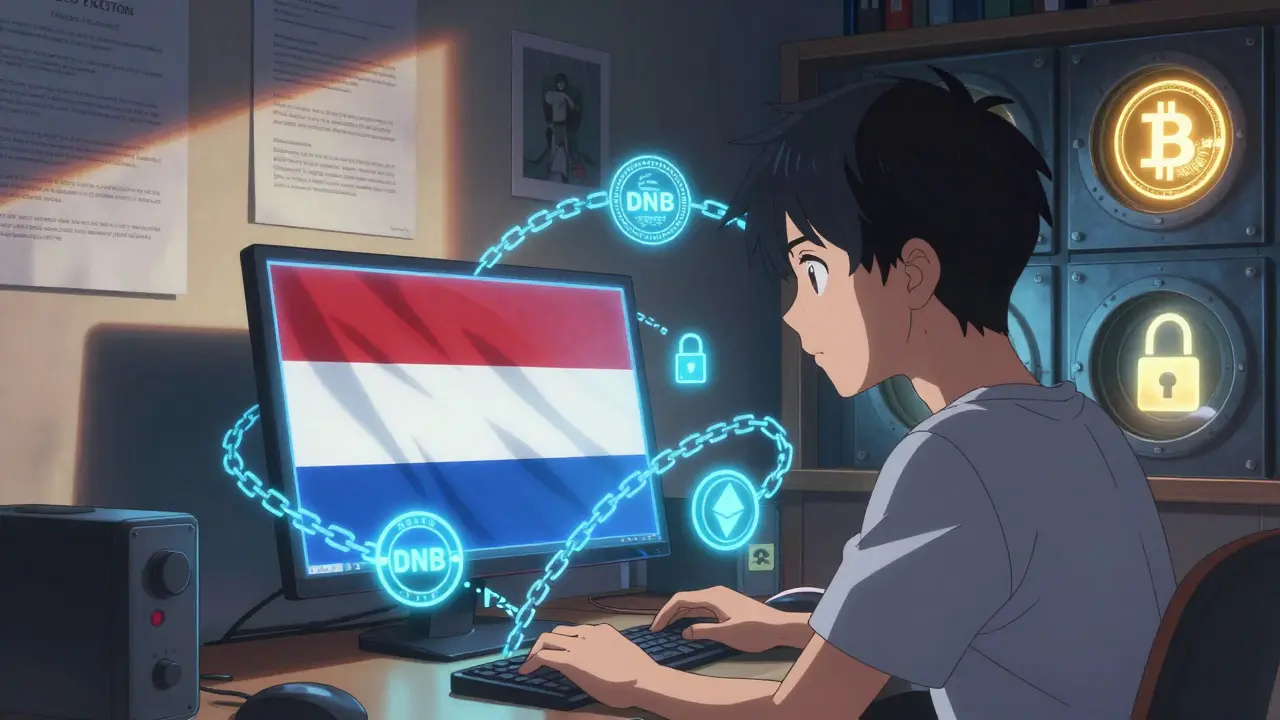

SATOS is a regulated Dutch crypto exchange offering secure, DNB-supervised trading for euros. With 1% fees and Dutch-only support, it's ideal for safety-focused users but not for low-cost traders.