Swap Efficiency Calculator

Calculate how RadioShack's graph optimization reduces swap costs on Celo. Enter your current swap parameters and see potential savings.

Results

Key Benefit: RadioShack reduces hops from to , cutting potential slippage by % and gas costs by .

Key Takeaways

- RadioShack (RADS) is a token, not a standalone exchange, built on the Celo blockchain.

- The protocol aims to shrink the token‑swap graph, which can lower slippage and improve liquidity efficiency.

- Compared with popular DEXs like Uniswap, RadioShack focuses on routing optimisation rather than pure AMM depth.

- Using RadioShack requires an EVM‑compatible wallet set to the Celo network (e.g., MetaMask).

- Limited public documentation and community chatter mean users should treat the project as high‑risk until more data emerges.

This review focuses on the RadioShack token and its role within the Celo ecosystem. We’ll explain what it is, how it works, who it might help, and what the open questions are for anyone considering a trade or integration.

What Is RadioShack (RADS)?

When you first see the name, you might think of the old electronics retailer. In crypto, however, RadioShack token (RADS) is a DeFi token built on the Celo blockchain that powers a liquidity‑optimising protocol. The token is listed on CoinMarketCap and trades against other Celo‑based assets, but it does not run a separate order‑book or centralized interface.

Its core purpose is to improve how swaps are routed inside decentralized exchanges (DEXs). By “reducing the diameter of the graph of swappable tokens,” RadioShack tries to cut the number of hops a trade must take, which should lower transaction costs and slippage for users.

Why Celo? The Underlying Blockchain

The Celo blockchain is an EVM‑compatible platform that targets mobile‑first users and emerging markets. After the March2022 Espresso hard‑fork, Celo gained full compatibility with the latest Ethereum upgrades, meaning developers can deploy standard Solidity contracts without major changes.

Key metrics as of October2025:

- ~500,000 daily active users

- $1.7billion in monthly stable‑coin volume

- $275million market cap for the Celo ecosystem overall

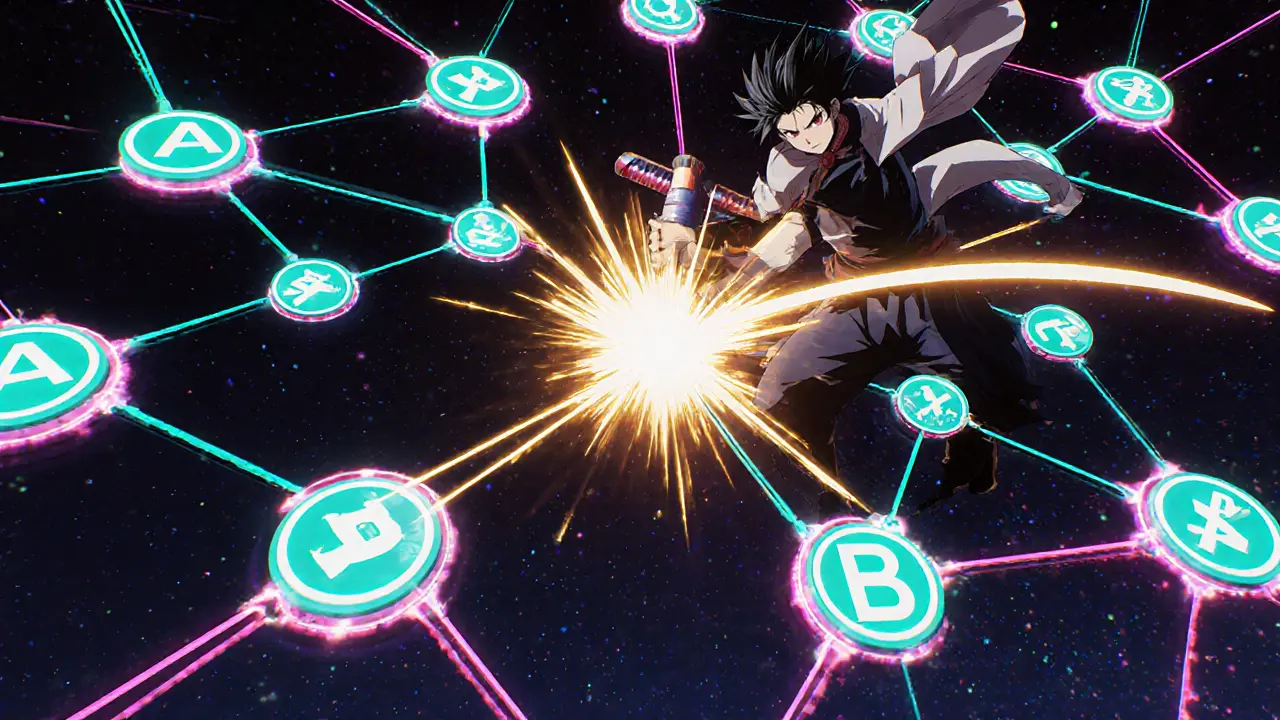

Technical Angle: Token‑Graph Optimisation

Most DEXs rely on automated market maker (AMM) pools that create a direct price curve between two tokens. When you want to swap TokenA for TokenC but no direct pool exists, the router hops through an intermediate token (often USDC). Each hop adds potential slippage and extra gas.

RadioShack’s protocol introduces a graph‑reduction algorithm that does two things:

- Identify the shortest path between any two assets across all Celo‑based pools.

- Concentrate liquidity on those “core” bridges, effectively shrinking the overall graph diameter.

In theory, this means a swap that would normally travel A → USDC → C could be shortened to A → B → C if B offers a tighter bridge, cutting the number of jumps from two to one.

Because the protocol lives atop Celo’s existing infrastructure, it inherits the network’s low‑gas fees (often <$0.001) and the recent Nightfall Layer3 privacy add‑on, which can mask transaction details for users who need confidentiality.

How RadioShack Differs From Other DEXs

| Feature | RadioShack (RADS) | Uniswap (Ethereum) | 1inch (Aggregator) |

|---|---|---|---|

| Primary Goal | Graph‑diameter reduction & liquidity concentration | Simple AMM pools | Best‑price routing across multiple sources |

| Underlying Chain | Celo | Ethereum | Multi‑chain (EVM + others) |

| Gas Cost (Typical) | ~$0.001 (Celo) | ~$2-$5 (Ethereum) | Varies, but often higher due to multiple calls |

| Liquidity Source | Concentrated bridges via RADS‑governed pools | Direct pool liquidity | Aggregated across many DEXs |

| Privacy Layer | Nightfall Layer3 (optional) | None native | None native |

While Uniswap dominates raw liquidity on Ethereum, RadioShack’s niche is efficiency on Celo. 1inch offers similar routing tricks but does so by calling multiple DEXs; RadioShack builds the optimization into its own protocol, potentially reducing latency.

Pros and Cons

Below is a quick risk‑reward snapshot you can refer to before moving any funds.

- Pros

- Lower gas fees thanks to Celo’s design.

- Potentially reduced slippage via graph optimisation.

- Access to Nightfall privacy for sensitive trades.

- RADS token can be used for governance or fee rebates (if the protocol rolls out such incentives).

- Cons

- Very limited public documentation - developers must reverse‑engineer contracts.

- Small community; few independent audits publicly available.

- Liquidity is concentrated in a few Celo pools, making large trades risky.

- Dependency on Celo’s overall health - any network slowdown affects RadioShack.

How to Use RadioShack: Step‑by‑Step Guide

- Install an EVM‑compatible wallet (MetaMask is the most common).

- Add the Celo network to your wallet. Use RPC URL

https://forno.celo.org, Chain ID42220. - Acquire some CELO to pay for transaction fees (even a few cents is enough).

- Visit a Celo‑based DEX that lists RADS - for example, CeloSwap (note: this is a placeholder, actual UI may vary).

- Select RADS in the swap interface, choose the token you want to trade for, and review the route preview. RadioShack’s algorithm will show the shortest hop path.

- Confirm the swap, sign the transaction in your wallet, and wait for the sub‑second confirmation typical of Celo.

- If you hold RADS, you can stake it (if a staking contract exists) to earn protocol fees - check the official docs for any launched incentive programs.

Because the ecosystem is still nascent, you may encounter UI quirks or missing token listings. Keeping a small amount of CELO on hand for gas and testing on a testnet (Alfajores) first is a wise precaution.

Security Considerations

The Celo security advisory dated October122025 reminded users to “prioritise hardware wallets and multi‑factor authentication.” That advice applies to RadioShack as well. Since the protocol’s smart contracts aren’t widely audited, treat any interaction as high‑risk:

- Use a hardware wallet (Ledger or Trezor) for large swaps.

- Enable MFA on any account that can trigger contract calls.

- Verify the contract address on multiple sources (CoinMarketCap, Celo Explorer).

- Consider sandboxing the token on a testnet before moving real funds.

No major hacks involving RadioShack have been reported, but the lack of public audits means the possibility of hidden bugs or malicious upgrades can’t be dismissed.

Roadmap & Future Outlook

Public roadmaps for RadioShack are scarce. The most we know is that the team (identity undisclosed) plans to integrate deeper with Celo’s upcoming Layer2 solutions and possibly launch a governance token model that lets RADS holders vote on fee structures.

If Celo continues its rapid growth - projected to hit $2.86billion in market cap by 2029 - we could see a corresponding uplift in RADS usage. However, the token’s success hinges on three factors:

- Community adoption: more developers need to build on the protocol.

- Audit transparency: third‑party security reviews will boost confidence.

- Incentive design: clear fee rebates or staking rewards will attract liquidity providers.

Until those pieces fall into place, treat RADS as an experimental asset.

Final Verdict

If you’re hunting for a low‑fee DEX on a mobile‑centric blockchain, RadioShack offers an interesting routing upgrade that could save you dollars on big swaps. But the scarcity of documentation, limited community, and lack of independent audits mean you should only allocate a modest portion of your portfolio.

In short, RadioShack is a promising technical concept wrapped in a token that’s still finding its footing. Keep an eye on Celo’s ecosystem updates - a breakthrough there could lift RadioShack’s utility dramatically.

Frequently Asked Questions

Is RadioShack a centralized exchange?

No. RadioShack is a token that powers a decentralized liquidity‑optimising protocol on the Celo blockchain. It does not run a traditional order‑book or custody service.

Do I need CELO to trade RADS?

Yes. CELO is the native gas token for the Celo network, so you’ll need a small amount of it to pay transaction fees when swapping RADS.

How does RadioShack reduce slippage?

By shortening the swap path across the token graph, the protocol reduces the number of intermediate hops. Fewer hops mean fewer price impacts and lower overall slippage.

Is there a staking or reward program for RADS holders?

As of October2025, no official staking or fee‑rebate program has been announced. The team has hinted at future governance incentives, but details remain undisclosed.

Where can I find the RADS smart‑contract address?

The contract address is listed on CoinMarketCap’s RADS page and can be verified on the Celo Explorer. Always double‑check the address before adding the token to your wallet.

Comments (14)

mark noopa

October 12, 2025 AT 08:38 AMWhen you stare at the inner workings of a DEX like RadioShack, you realize it’s not just code, it’s a mirror of our collective desire for efficiency 😊. The way the protocol chops down hop counts feels like a philosopher trimming away superfluous thoughts to reach the core truth. Every extra hop is a layer of illusion, a veil that blinds traders to the pure price signal 🚀. By reducing those layers, you’re not just saving gas, you’re decluttering the mental clutter that drags on our wallets. Some might say it’s just another token gimmick, but look deeper: the graph‑reduction algorithm is a subtle rebellion against the chaos of uncontrolled AMM paths. In a world where DeFi projects multiply like weeds, a tool that prunes the excess can be seen as a gardener of rationality. The Celo network’s low‑fee environment only amplifies this effect, turning what could be a negligible gain into a noticeable edge. Imagine swapping A for C without the dreaded USDC bridge, feeling the smooth glide of a single hop – that’s the promise whispered by the whitepaper. Yet the promise is shrouded in limited documentation, a fog that only the brave or the foolhardy will wade through. If you’re willing to navigate that fog, you might discover that the token’s value is less about speculation and more about utility. In practice, the optimization can shave off fractions of a percent in slippage, which compounds over thousands of trades. For a DeFi farmer, those fractions become the harvest; for a casual user, they become the peace of mind that your trade didn’t bleed away. The community chatter is sparse, but the few voices that echo tell a story of cautious optimism, a chorus that says “maybe”. And maybe is a powerful word; it holds both hope and restraint in equal measure. So, while the token itself may swing like a pendulum between hype and skepticism, the underlying technology feels like a step toward a more elegant swap experience. In the grand tapestry of crypto, it might just be the quiet thread that holds the pattern together. 🚀😊

Helen Fitzgerald

October 18, 2025 AT 01:28 AMHey folks! If you’re feeling a bit lost in the sea of DEX jargon, just remember that RadioShack’s main goal is to make your swaps smoother. Think of it like a personal trainer for your trades – trimming the fat so you get the results faster. Grab a coffee, plug your wallet into Celo, and give the optimizer a spin. You might be surprised how a few fewer hops can lift the whole experience! Keep experimenting and share what you discover; the community grows stronger together.

Mureil Stueber

October 23, 2025 AT 18:17 PMRadioShack reduces hop count it cuts slippage and gas adds efficiency for traders on Celo it’s a neat tool for those who want quick swaps without extra steps

Leo McCloskey

October 29, 2025 AT 10:07 AMHonestly, the entire premise of "optimising graph diameter" is nothing short of a buzzword‑laden exercise in techno‑jargon; one must ask: does this theoretical reduction translate to tangible user‑level savings, or is it merely an academic curiosity?; the protocol’s reliance on existing Celo liquidity pools raises concerns about centralisation risks, especially when the underlying bridges remain unaltered; furthermore, the lack of comprehensive audits only deepens the murkiness surrounding its security posture.

arnab nath

November 4, 2025 AT 02:57 AMEveryone talks about "efficiency" as if the system is benign, but nobody mentions the hidden backdoors that could let a few insiders reroute swaps and siphon fees. Stay vigilant.

debby martha

November 9, 2025 AT 19:47 PMi think it's kinda overhyped, not sure if the savings are worth the hype.

Ted Lucas

November 15, 2025 AT 12:36 PM🚀 Let’s get pumped! This optimizer is exactly what the DeFi hustle needs – less gas, more gains! If you’re on Celo, fire up your wallet and feel the power of a streamlined swap. Trust me, you’ll see the difference instantly! 💥💎

Nina Hall

November 21, 2025 AT 05:26 AMWow, this looks promising! I love seeing tools that actually try to make our trades easier. Let’s keep an eye on how the community adopts it and share any cool findings. 🌈

Sanjay Lago

November 26, 2025 AT 22:16 PMTotally agree, Nina! It’s like giving our wallets a shortcut through traffic. I’m curious how it behaves under heavy load – maybe we should run a few stress tests on the testnet?

Nathan Van Myall

December 2, 2025 AT 15:06 PMThe math checks out.

gayle Smith

December 8, 2025 AT 07:55 AMOh my gosh, can we just talk about how *dramatic* this whole "graph reduction" thing sounds? It’s like the DeFi world is starring in its own sci‑fi thriller, and I am *here* for every twist! 🎭✨

Jon Asher

December 14, 2025 AT 00:45 AMSounds like a good idea. Let’s see how it works.

Ben Parker

December 19, 2025 AT 17:35 PM👍 Looks interesting! Can't wait to try it out and see the savings unfold 😎🚀

Emily Kondrk

December 25, 2025 AT 07:38 AMListen up, the so‑called "optimiser" is just another layer of the illusion that the elite use to keep us distracted. While they brag about fewer hops, the real puppeteers are pulling strings behind the scenes, ensuring that every "efficiency" metric feeds the same old profit machine. Stay awake, stay skeptical, and never trust a whitepaper that sounds too good to be true. 🌌🕵️♀️