By 2026, cryptocurrency taxation isn’t just complicated-it’s fundamentally different from what it was five years ago. If you’ve been holding, trading, or earning crypto and haven’t updated your tax strategy, you’re at risk. The IRS isn’t asking nicely anymore. They’re tracking every transaction, and the rules have changed in ways that catch even experienced investors off guard.

Everything You Do With Crypto Is Taxable

You don’t need to sell your Bitcoin to owe taxes. Buying coffee with Ethereum? Taxable event. Swapping Solana for Polygon? Taxable event. Even getting paid in crypto or earning staking rewards? That’s ordinary income. The IRS still treats crypto as property, not currency, which means every transfer triggers a potential tax liability.

Here’s how it breaks down:

- Ordinary income tax: Applies when you earn crypto through mining, staking, airdrops, or payroll. Rates range from 10% to 37%, depending on your total income.

- Short-term capital gains: If you sell or trade crypto you held less than a year, you pay your regular income tax rate-same as your salary.

- Long-term capital gains: Hold crypto over a year? You get lower rates: 0%, 15%, or 20%, based on your taxable income. For 2025, single filers pay 15% if their income is between $48,350 and $533,400.

And that’s just the federal side. States like California and New York add their own taxes on top. For high earners, total tax on crypto gains can easily hit 30% or more when you combine federal, state, and the 3.8% Net Investment Income Tax.

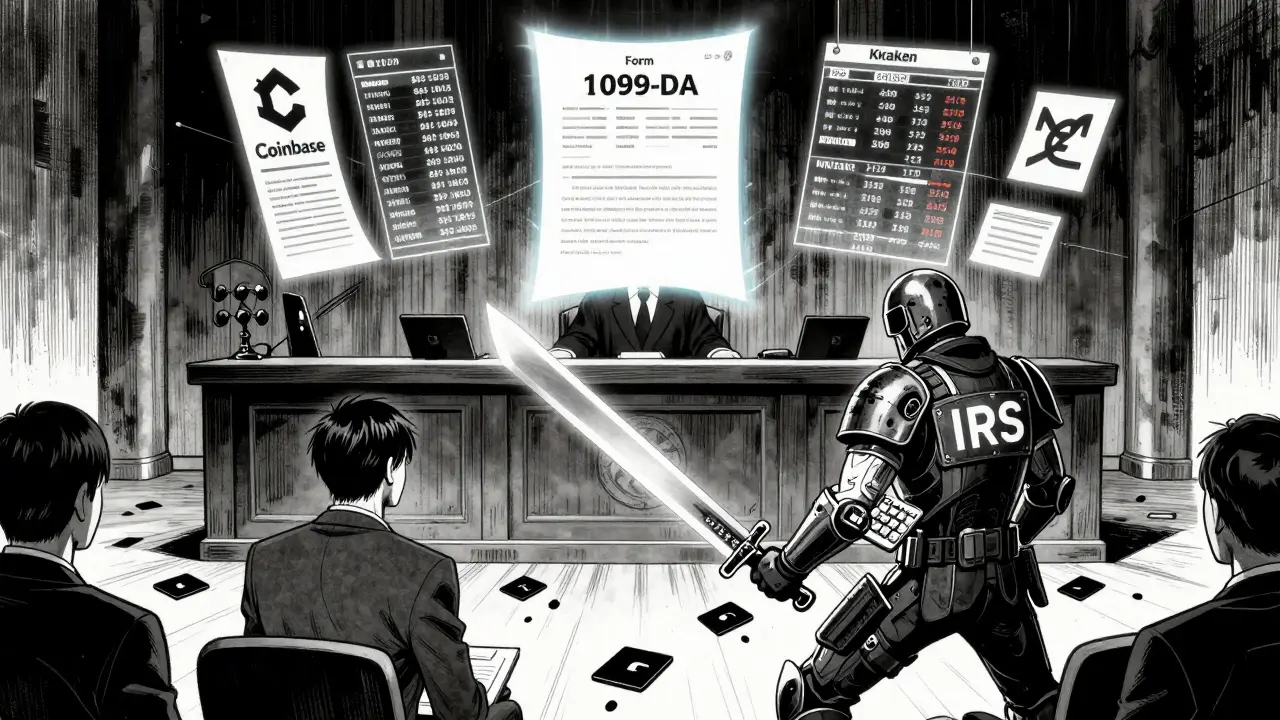

The Big Change: Form 1099-DA Is Here

Starting January 1, 2025, every U.S. crypto exchange-Coinbase, Kraken, Binance US, you name it-had to start issuing Form 1099-DA. This isn’t just another tax form. It’s the crypto version of the 1099-B that brokers use for stocks. Exchanges now report every sale, trade, and cash-out you make. The IRS gets a copy. No more guessing. No more “I didn’t know I had to report it.”

What gets reported? Everything:

- How much crypto you sold

- The date of the transaction

- The fair market value in USD at the time

- The cost basis (if the exchange can calculate it)

This is a game-changer. Before 2025, the IRS had to rely on self-reporting. Now, they have automated, real-time data. If your report doesn’t match what the exchange says, you’ll get a letter. And those letters lead to audits.

Wallet-by-Wallet Accounting Is Now Required

Here’s where most people get tripped up: the IRS killed the universal accounting method. That means you can’t just average your crypto purchases anymore. You must track cost basis for every single wallet you own.

Imagine this: You bought 1 BTC in 2020 for $10,000 in Wallet A. In 2024, you bought another 1 BTC for $65,000 in Wallet B. You sell 0.5 BTC in 2025. Which purchase are you selling from? Wallet A? Wallet B? The IRS now requires you to specify. If you don’t, they’ll assume the oldest coins (FIFO) were sold-and that might not be the most tax-efficient choice.

And here’s the kicker: you must track transfers between your own wallets. Sending crypto from Coinbase to a Ledger? That’s a taxable event if you’re using different accounting methods. The system isn’t fully automated yet, so the burden falls on you. You need a detailed log of every transfer, every date, every value.

NFTs and Collectibles Pay More

If you’re trading NFTs, you’re not just subject to regular capital gains. The IRS classifies many NFTs as collectibles. That means long-term gains on NFTs are taxed at up to 28%-higher than the standard 20% rate for Bitcoin or Ethereum. That’s a big deal. A $50,000 profit on an NFT held for two years could cost you $14,000 in taxes. The same profit on Bitcoin? Just $10,000.

It’s not just NFTs. Some crypto tokens that act like digital art, rare items, or collectible assets may also fall under this rule. If it’s not a currency or a utility token, assume it’s a collectible until proven otherwise.

The Wash Sale Rule Is Coming (Probably)

Right now, you can sell Bitcoin at a loss, then buy it back the next day and claim the loss on your taxes. That’s called tax-loss harvesting. It’s a legal and smart strategy. But the Biden administration proposed extending the wash sale rule to crypto in the 2025 budget.

If that rule passes, you won’t be able to claim a loss if you buy the same or “substantially identical” asset within 30 days before or after the sale. That’s exactly how it works with stocks. The change isn’t law yet in 2026, but most tax pros believe it’s coming. Don’t assume it won’t happen. Plan as if it’s already in effect.

Charitable Donations Are Your Best Friend

If you’ve got crypto that’s gone up in value, don’t sell it. Donate it.

Here’s why: When you donate crypto you’ve held over a year to a qualified charity, you get a tax deduction equal to its fair market value. And you pay $0 in capital gains tax. That’s a double win. Say you bought $5,000 worth of Ethereum and it’s now worth $25,000. Sell it? You owe taxes on $20,000. Donate it? You deduct $25,000. No tax. Same benefit to the charity.

Many nonprofits now accept crypto directly. Organizations like the Red Cross, UNICEF, and even local animal shelters have crypto wallets. It’s simple, legal, and powerful.

What Happens If You Didn’t Report Past Crypto?

It’s not too late. But you need to act fast.

The IRS has tools to cross-reference Form 1099-DA data with past returns. If you didn’t report crypto income from 2021, 2022, or 2023, they’ll find it. The penalty for underreporting? Interest, fines, and in extreme cases, criminal charges.

But there’s a way out: the IRS Voluntary Disclosure Program. If you come forward before they contact you, you can file amended returns and pay what you owe with reduced penalties. The window is closing. Don’t wait.

How to Stay Compliant in 2026

You need three things:

- A full transaction history: Export all trade logs from every exchange, wallet, and DeFi platform you’ve used. Include dates, amounts, USD values, and transaction IDs.

- A tax calculator that handles wallet-by-wallet accounting: Tools like Koinly, CoinTracker, or ZenLedger can auto-import data and calculate gains/losses per wallet. Don’t rely on spreadsheets unless you’re a tax accountant.

- A crypto-savvy CPA: Most general tax preparers still don’t understand crypto. Find someone who’s filed at least 20 crypto returns in the last year. Ask for references.

Also, keep records for at least seven years. The IRS can audit crypto returns going back that far.

What’s Next? The Road Beyond 2026

The future of crypto taxation is clearer reporting, more automation, and tighter integration with traditional finance. Expect:

- Brokers to start reporting transfers between platforms (like how banks report stock transfers).

- More states to adopt crypto tax reporting laws.

- DeFi protocols to be required to issue 1099s, not just centralized exchanges.

- Possible changes to how mining and staking rewards are taxed-possibly treated as business income.

The trend is undeniable: crypto is being brought into the mainstream tax system. The days of flying under the radar are over. The question isn’t whether you’ll be taxed-it’s whether you’ve prepared.

Do I owe taxes if I just hold crypto and don’t sell?

No. Holding crypto without selling, trading, or earning rewards isn’t a taxable event. You only owe taxes when you dispose of crypto-meaning you sell it, trade it for another asset, use it to buy goods/services, or receive it as income from staking or mining.

What if I lost money on crypto? Can I deduct it?

Yes, but only if you sold or traded it at a loss. Capital losses can offset capital gains first, then up to $3,000 of ordinary income per year. Any extra loss carries forward to future years. But if you just held crypto and its value dropped, that’s not a deductible loss-you have to realize it by selling.

Are crypto-to-crypto trades taxed differently than crypto-to-fiat?

No. Both are taxable events. Trading Bitcoin for Ethereum is treated the same as selling Bitcoin for U.S. dollars. You must calculate the gain or loss based on the USD value at the time of the trade. Many people mistakenly think swapping crypto is tax-free-it’s not.

Can I use FIFO, LIFO, or specific identification for crypto?

You can use specific identification, but only if you track each coin’s cost basis and can prove which one you sold. FIFO (first-in, first-out) is the default if you don’t specify. LIFO is not allowed for crypto under current IRS guidance. You must document your choice clearly to avoid audit risk.

Do I need to report crypto earned from airdrops or hard forks?

Yes. Airdrops and hard forks are treated as ordinary income at the time you gain control of the new tokens. The value is based on the fair market value in USD on the day you can access and use them. If you don’t report it, you’re underreporting income.