On June 1, 2025, China made it illegal to own, trade, or mine any cryptocurrency - not just Bitcoin or Ethereum, but all digital assets. This wasn’t a surprise. It was the final step in a 16-year campaign to wipe out private digital money from its borders. What started as warnings in 2009 turned into bank bans, exchange shutdowns, mining crackdowns, and finally, a total prohibition. Today, if you’re in China and you hold Bitcoin, you’re breaking the law. And if you’re caught, your coins can be seized - no warning, no appeal.

How China Got to a Total Crypto Ban

China didn’t wake up one day and decide to ban crypto. It built the ban brick by brick. In 2009, the government first warned against using virtual currencies to buy real goods. By 2013, banks were told not to touch Bitcoin transactions. In 2014, trading accounts were shut down. In 2017, Initial Coin Offerings (ICOs) were outlawed, and exchanges like Huobi and OKEx were forced to close their doors in mainland China. By 2018, mining was already being pushed out. Then, in June 2021, the government shut down all crypto mining operations, citing energy waste and financial instability. Millions of mining rigs were unplugged overnight. Many were shipped overseas - to Kazakhstan, the U.S., and even Canada.The 2021 ban didn’t stop people. Many turned to VPNs to access foreign exchanges like Binance or Coinbase. They kept trading. They kept holding. But in May 2025, the People’s Bank of China (PBOC) dropped the final hammer: a complete ban on all cryptocurrency activities, including private ownership. Now, even holding Bitcoin in a personal wallet is illegal. Accessing foreign platforms through a VPN? Illegal. Mining with a hidden rig? Illegal. Selling crypto to a friend? Also illegal.

How Seizures Work in Practice

China’s enforcement isn’t just about fines. It’s about confiscation. Authorities don’t need a court order to take your crypto. If they suspect you’re holding digital assets, they can seize your devices - laptops, phones, hardware wallets - and use forensic tools to find private keys. In some cases, they’ve used thermal imaging to detect overheating mining rigs hidden in basements. In others, they’ve tracked bank transfers linked to crypto purchases.One case in 2025 involved a man in Shenzhen who kept 12 Bitcoin in a hardware wallet tucked inside a false wall. Authorities found it after tracing his electricity usage - mining rigs draw massive power. He was fined 500,000 yuan (about $70,000) and forced to surrender the coins. The Bitcoin was later auctioned off by the state, with proceeds going to local government funds.

These seizures aren’t rare. Since 2021, Chinese courts have reported over 3,200 crypto confiscation cases. The average seizure size is around 15 Bitcoin, but some cases involve hundreds of coins. The government doesn’t publicly disclose how many total coins have been seized, but experts estimate the total value exceeds $10 billion since 2021.

Why China Won’t Let Crypto Survive

China’s goal isn’t just to stop speculation. It’s to control every digital transaction. The state-backed digital yuan - known as e-CNY - is the centerpiece of this strategy. Unlike Bitcoin, the digital yuan is fully traceable. The government knows who sent money to whom, when, and for what. It can freeze accounts, limit spending, or even set expiration dates on digital cash.By banning crypto, China removes competition. No one can use an untraceable, decentralized currency to avoid capital controls or move money out of the country. No one can bypass the state’s financial surveillance. The digital yuan isn’t just a payment tool - it’s a control mechanism. And crypto, with its anonymity and global reach, is the only thing that could undermine it.

Analysts from the Brookings Institution and the Bank for International Settlements agree: China’s crypto ban isn’t about risk. It’s about power. Other countries regulate crypto. China eradicates it.

The Global Ripple Effect

China’s crackdown didn’t stay inside its borders. When mining was banned in 2021, the global Bitcoin hash rate dropped by over 50% in weeks. Miners relocated, and new mining hubs popped up in Texas, Canada, and Georgia. When exchanges were forced to leave China in 2017, Binance and OKX moved their headquarters to Malta, Singapore, and the Cayman Islands. Today, fewer than 2% of global Bitcoin transactions originate from within China.But the biggest international impact came from a 2018 case in the UK. British police raided the home of a Chinese national and seized 61,000 Bitcoin - worth $5.5 billion at the time - linked to a Ponzi scheme that defrauded over 128,000 people. The UK wanted to use the funds to compensate victims. China demanded the coins be returned to them, arguing the assets were stolen from Chinese citizens. The case remains unresolved, highlighting how China’s crypto ban now has global legal complications.

What Happens If You Try to Bypass the Ban?

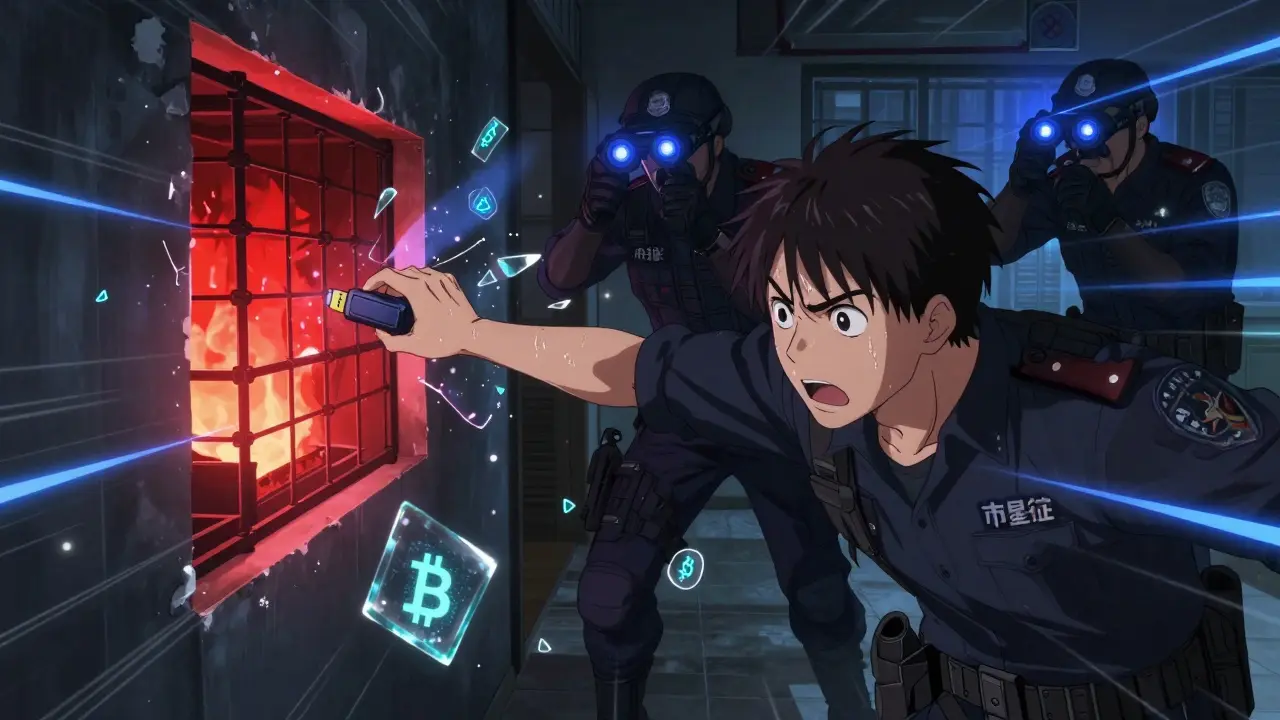

Some people still try. They use peer-to-peer apps like LocalBitcoins or Telegram groups to trade crypto in secret. Others hide wallets on USB drives or use decentralized exchanges that don’t require KYC. But the risks are high.China’s internet surveillance system - known as the Golden Shield - now flags traffic to known crypto domains. If you connect to a foreign exchange through a VPN, your ISP may report you. If you make a bank transfer to a crypto exchange, even indirectly, your account can be frozen. Penalties range from fines to jail time. In 2024, a man in Hangzhou was sentenced to two years in prison for using a crypto wallet to pay for overseas services.

There’s no gray area. Even if you bought Bitcoin in 2015 and never touched it since, you’re still in violation. The law doesn’t care when you got it. It only cares that you still have it.

What This Means for the Future

There’s no sign China will reverse course. The digital yuan is now used by over 700 million people. State banks are pushing it for salaries, taxes, and social welfare payments. The government has already started integrating it into public transport, healthcare, and education systems. Crypto has no place in this future.Some experts thought China might allow institutional crypto trading - like hedge funds holding Bitcoin - but that idea was quietly buried in 2024. Even institutional access is off the table. China wants total control. Not regulation. Not oversight. Total control.

For the rest of the world, China’s ban is a warning. It shows how a government with strong surveillance, centralized banking, and no tolerance for dissent can eliminate a technology overnight. It’s not about technology. It’s about who controls money.

How This Compares to Other Countries

Compare China to the U.S. or EU. The U.S. has SEC lawsuits, tax reporting rules, and licensed exchanges. The EU has MiCA regulations that let you trade crypto legally under certain conditions. Japan allows crypto exchanges with licenses. Even Russia, despite sanctions, lets citizens hold Bitcoin.China is the only country that made ownership itself a crime. No other major economy has gone this far. And no other country has the infrastructure - or the will - to enforce it so thoroughly.

China’s approach isn’t just strict. It’s unique. And it’s working - for them.

Comments (16)

Bill Sloan

January 13, 2026 AT 13:00 PMBro this is wild 😳 I mean, holding Bitcoin is now a CRIME? In 2025? China just turned into a digital dystopia. I thought we were past this stuff. They’re literally hunting people down for crypto wallets like it’s 1984 with more servers. 🤯

ASHISH SINGH

January 15, 2026 AT 06:30 AMLMAO classic communist move. They ban what they can’t control. The digital yuan? A surveillance leash wrapped in a QR code. They don’t want money - they want your soul. And the mining rigs? All shipped to Texas where the oil barons are now Bitcoin cowboys. The irony? The state’s own AI is probably mining crypto in the shadows. 😏

Vinod Dalavai

January 16, 2026 AT 19:21 PMHonestly? I get it. I really do. I’ve seen how crypto can be used to slip money out of countries with no oversight. But banning ownership? That’s like banning pens because someone wrote a protest letter. Maybe they’re scared. Maybe they’re wrong. But they’re not stupid.

Chidimma Okafor

January 18, 2026 AT 15:17 PMThis is a chilling example of state sovereignty over financial autonomy. The implications for global monetary systems are profound. The digital yuan’s architecture enables granular control that fundamentally alters the social contract between citizen and state. One must consider not only the technological implications, but the ethical erosion of privacy.

Andre Suico

January 18, 2026 AT 17:48 PMWhile the enforcement mechanisms described are extreme, it’s worth noting that China’s approach is consistent with its broader financial policy framework. The state prioritizes stability, capital control, and systemic oversight. Whether one agrees with it or not, the strategy is coherent - if authoritarian.

Michael Jones

January 20, 2026 AT 12:18 PMThe seizure process described is legally dubious even under China’s own laws. Forensic device seizures without warrants? Thermal imaging to detect mining rigs? That’s not enforcement - that’s digital witch hunting. And auctioning seized Bitcoin? That’s the state becoming a crypto exchange. The hypocrisy is staggering.

Lauren Bontje

January 22, 2026 AT 01:57 AMTypical Chinese authoritarian overreach. They can’t compete with freedom so they outlaw it. Meanwhile, America lets people buy Bitcoin with their tax refund. Guess which economy’s growing? China’s just building a digital prison and calling it progress.

Stephanie BASILIEN

January 22, 2026 AT 03:42 AMIt’s fascinating, really - the way the PBOC weaponizes liquidity. The digital yuan isn’t currency; it’s a behavioral algorithm. Crypto’s anonymity represents the last vestige of individual economic sovereignty. And China, ever the architect of control, has chosen to eradicate it rather than adapt. How… tragic.

Deb Svanefelt

January 22, 2026 AT 16:28 PMI think about the people who bought Bitcoin in 2013 and held it through every crash, every meme, every hype cycle - only to have it taken because they lived in the wrong country. It’s not about money. It’s about trust. When your government sees your savings as a threat, what’s left? The silence of a million wallets going dark.

Telleen Anderson-Lozano

January 22, 2026 AT 17:45 PMI mean, I get the control thing, but… like… why not just tax it? Or regulate it? Why go full surveillance state? They’re not just banning crypto, they’re banning the idea that money can be… decentralized. That’s a scary thought. And also, the thermal imaging thing? That’s next-level creepy. Like, who approved that? Who signed off on that?!

Haley Hebert

January 22, 2026 AT 20:58 PMI just feel so sad for the people in China who believed in crypto as freedom. I remember when I bought my first BTC in 2017 - it felt like a rebellion. Now it’s just… a crime. And they’re auctioning it off like it’s stolen art. It’s not stolen. It’s theirs. And now it’s gone. I hope they find peace somewhere else.

Jill McCollum

January 23, 2026 AT 20:04 PMok but like… the digital yuan is basically just a super advanced paypal with a side of big bro 😅 i mean, if you can track every coffee purchase… why even need crypto? but also… i feel bad for the miners. my cousin worked at a farm in szechuan and now he’s driving uber in kansas. life is weird.

Hailey Bug

January 24, 2026 AT 12:21 PMThe 3,200+ confiscation cases are real. The $10B+ estimate is conservative. China has seized more Bitcoin than any government in history. They’re not just banning it - they’re hoarding it. And they’re using it to fund local infrastructure. The state is the largest BTC holder now. No one talks about that.

Dustin Secrest

January 25, 2026 AT 06:30 AMThere’s a philosophical layer here. Crypto was supposed to be the people’s money. But when a state decides that money itself must be owned by them - not just regulated, but owned - what does that say about the future of human autonomy? We’re not just talking about Bitcoin. We’re talking about the soul of economic freedom.

Josh V

January 26, 2026 AT 22:33 PMChina bans crypto so hard they make it look like a sci-fi movie. Miners fleeing to Texas. Police using heat cams. Bitcoin auctions. The whole thing is insane. And yet… they’re winning. The digital yuan is everywhere. The people are compliant. The world is watching. And no one’s doing anything.

Stephen Gaskell

January 27, 2026 AT 06:21 AMTotal ban. No exceptions. No loopholes. That’s strength. Other countries are weak. They negotiate with criminals. China ends it. Period. The digital yuan is the future. Crypto is the past. And the past belongs in the trash.