When Vietnam announced Directive 05/CT-TTg in September 2025, it didn’t just tweak its crypto rules-it rewrote the entire game. This wasn’t a gentle nudge toward regulation. It was a hard stop for small players and a high-wall entrance for only the deepest pockets. The government didn’t ask for feedback. It didn’t offer a transition plan with breathing room. It set a minimum capital requirement of 10 trillion VND-roughly $379 million-and said, ‘This is the price of staying in Vietnam.’

Why 10 Trillion VND? The Real Reason Behind the Number

At first glance, $379 million seems absurd for a crypto exchange. But look deeper. Vietnam’s unregulated market had grown to $1.2 billion in annual volume, with over 21 million active users. In 2022, 15 unlicensed platforms collapsed overnight, wiping out hundreds of millions in user funds. The government saw a pattern: small operators, low capital, no accountability. So they built a filter-not to stop fraud, but to eliminate the entire class of small, risky exchanges.

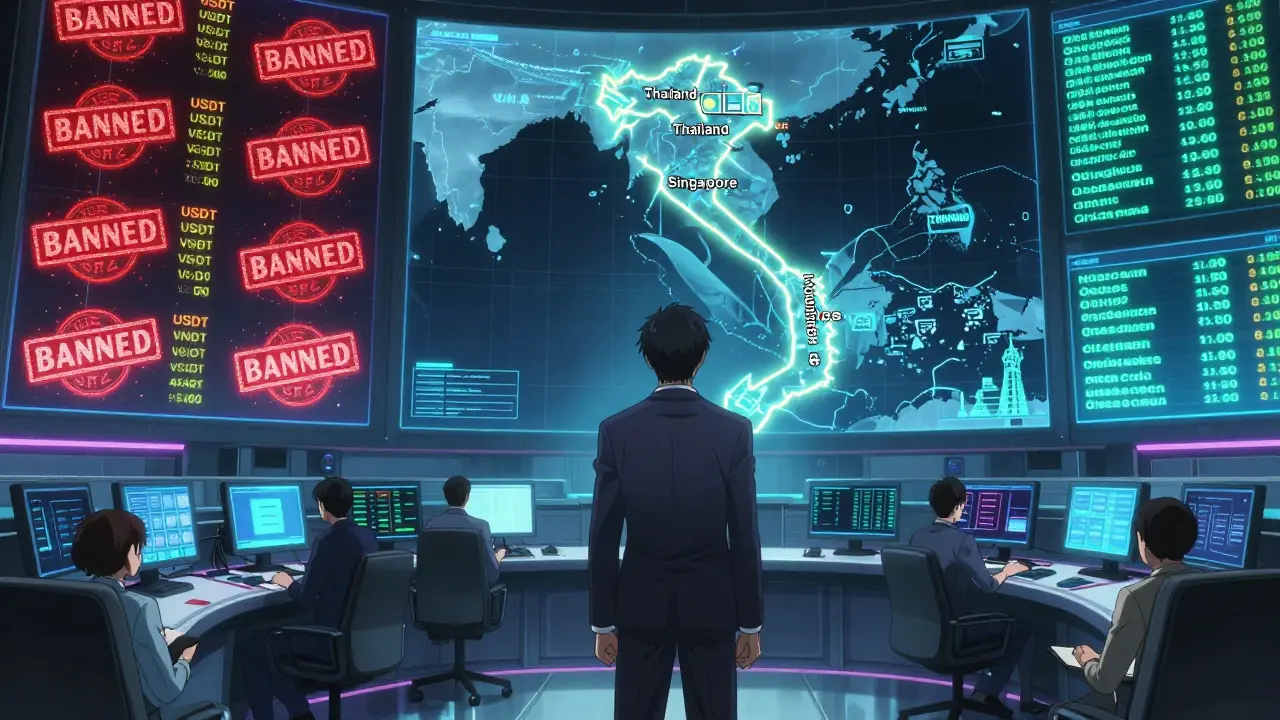

The number isn’t random. It’s 27 times higher than Thailand’s requirement and 27.5 times greater than Singapore’s lowest tier. It’s designed so only state-aligned institutions or foreign giants with deep local partners can apply. Foreign ownership? Capped at 49%. That means even if you’re a U.S. exchange with billions, you can’t run this alone. You need a Vietnamese majority partner. And that partner? They have to put up at least 6.5 trillion VND of their own money.

VND-Only Transactions: Cutting Off the Global Flow

Most countries let you trade crypto in USD, EUR, or stablecoins. Vietnam says no. Every trade must happen in Vietnamese dong. This isn’t about currency control-it’s about tracking. The State Bank of Vietnam now demands every transaction flows through its real-time monitoring system. That means no Binance, no Bybit, no offshore wallets. If you’re trading on an unlicensed platform, your activity is invisible to regulators. Licensed ones? Every buy, sell, or transfer is logged, timestamped, and tagged.

This rule kills stablecoins. Over 63% of crypto transactions in Vietnam used USDT or USDC before this law. Now, those tokens are banned if they’re backed by fiat. You can’t issue a token pegged to the dollar. You can’t even use a token backed by gold or real estate if it’s tied to foreign currency. The only acceptable assets? Those with physical, non-monetary backing-like renewable energy credits or agricultural commodities. It’s a technical loophole that makes trading nearly impossible for everyday users.

The Human Cost: 21 Million Users, 5 Million Allowed

Imagine you’ve been trading crypto for three years. You started with $500. You’ve built a small exchange for your friends in Hanoi. You have 5,000 users. You’re profitable. You pay taxes. You’ve never had a hack. Then, the law drops. Your capital? $190,000. The requirement? $379 million. You can’t raise it. You can’t find a partner. You shut down. That’s not hypothetical. That’s what happened to dozens of platforms in October 2025.

Statista estimates that 18-20 million users will be displaced in the first year. Most won’t disappear-they’ll just move offshore. Reddit threads like r/VietCrypto are full of users saying, ‘I’ll use Binance. I don’t care if it’s illegal. At least I can trade.’ Trustpilot data shows Vietnamese users rated unlicensed exchanges 4.2 stars for speed and low fees. Licensed ones? Nobody knows yet. No licensed exchange has launched.

But it’s not all bad. Institutional investors are cheering. One investor, known online as ‘SaigonVC,’ lost $455,000 in a 2024 scam. Now he says, ‘Finally, someone’s serious.’ The government’s goal isn’t to make crypto easy-it’s to make it safe. For them, safety means control. For users, safety means access.

Who Can Even Apply? The Hidden Barriers

The Ministry of Finance says applications open within 30 days. But here’s the catch: you need proof of three years in financial services. That means you can’t be a startup. You can’t be a blockchain team from Ho Chi Minh City. You need to be a bank, a brokerage, or a state-owned enterprise. Even then, you need to show you can raise 10 trillion VND in 15 banking days. That’s not 15 days. That’s 15 business days-meaning holidays, weekends, and bank processing delays aren’t counted.

Legal firms estimate compliance costs between $1.9 million and $7.6 million per platform. That’s not the license fee. That’s the cost to rebuild your entire system: new KYC software, blockchain integration with NDAChain, VND settlement engines, audit trails, and staff training. Most platforms spent $200,000 to $500,000 to stay compliant before. Now? They need 100 times more.

What Happens Next? The Five-Year Experiment

This isn’t permanent. It’s a five-year pilot. Reviews are scheduled at 12, 24, and 36 months. The government says it will adjust based on market stability. But what does that mean? If only 3-5 exchanges get licenses and serve 5 million users, will they lower the cap? Or will they double it to ‘prove’ the system works?

Tax rules are coming. By November 2025, capital gains will be taxed at 0.1% for trades under 100 million VND and 0.3% for larger ones. That’s low-but only if you’re licensed. Unlicensed traders? They’re invisible. And if caught? Fines up to 10% of transaction value, plus criminal charges.

The real question isn’t whether this will work. It’s whether Vietnam wants a crypto market-or just a controlled one. The world’s second-highest crypto adoption rate is now being forced into a box too small to breathe. The people who built this market won’t survive. The ones who do will be giants with government ties.

The Bigger Picture: Southeast Asia’s Divided Path

Thailand licensed 12 exchanges. Singapore lets foreign operators in. Indonesia bans retail trading but allows institutional futures. Vietnam chose something different: a state-monopoly model. It’s not about innovation. It’s about control. The government doesn’t want to ban crypto. It wants to own it.

By 2030, Vietnam hopes regulated crypto contributes 1.2-1.8% of GDP. That’s $3-4.5 billion in annual value. But if only 5% of users stay, can they reach that? Or will the market just go underground, with peer-to-peer trades and offshore apps replacing the old exchanges?

One thing’s clear: Vietnam didn’t build a framework for traders. It built one for banks. And the traders? They’re on their own.

Can foreign companies operate crypto exchanges in Vietnam under Directive 05/CT-TTg?

No, not independently. Foreign companies can own up to 49% of a licensed crypto exchange in Vietnam, but the majority (51% or more) must be held by Vietnamese entities. This means international firms must partner with local investors who meet the 10 trillion VND capital requirement. Direct foreign operation without a local majority partner is not permitted under the current framework.

Why are stablecoins banned in Vietnam’s new crypto framework?

Stablecoins backed by fiat currencies like the U.S. dollar are explicitly prohibited under Article 5, Clause 3 of Directive 05/CT-TTg. The government wants to prevent capital flight and maintain control over the Vietnamese dong (VND). Only crypto assets backed by non-monetary, real-world assets-such as energy, land, or commodities-are allowed. This eliminates popular tokens like USDT and USDC, which made up over 63% of Vietnam’s crypto volume before the law.

What happens to users of unlicensed crypto exchanges after the grace period?

After the six-month grace period following the first license issuance, unlicensed exchanges are required to shut down. Users can no longer legally trade on these platforms. While there are no direct penalties for users, trading on unlicensed platforms becomes legally risky. Withdrawals may be frozen, and funds could be subject to seizure if regulators identify the platform as operating illegally. Most users are expected to migrate to offshore exchanges or stop trading altogether.

How does Vietnam’s capital requirement compare to other countries in Southeast Asia?

Vietnam’s 10 trillion VND ($379 million) requirement is the highest in Southeast Asia. Thailand requires 500 million THB ($13.7 million), Singapore’s minimum for Tier-1 providers is around $13.8 million, and Indonesia bans retail trading entirely. Vietnam’s requirement is roughly 27 times higher than Thailand’s and over 27 times greater than Singapore’s lowest tier. This makes it one of the most restrictive regimes in the region, designed to exclude small operators and startups.

Is there a chance the capital requirement will be lowered in the future?

It’s possible, but unlikely in the short term. The framework includes mandatory reviews at 12, 24, and 36 months, where regulators will assess market stability, user retention, and compliance costs. If only 3-5 exchanges qualify and user numbers drop below 5 million, pressure may build to adjust the rule. However, the government’s priority is control, not accessibility. Any change would likely be slow, cautious, and tied to political goals-not user demand.