Tunisia doesn’t just restrict cryptocurrency - it outlaws it. Since May 2018, every form of crypto activity, from buying Bitcoin to mining Ethereum, is illegal under Tunisian law. No exceptions. No gray areas. If you’re caught trading, exchanging, or even holding digital assets, you could face jail time. This isn’t a vague warning. It’s a criminal offense with real consequences.

What’s Actually Banned?

The Central Bank of Tunisia (BCT) issued a blanket ban that covers everything. You can’t buy crypto on Binance or Coinbase. You can’t use it to pay for goods at a local shop. You can’t mine it with a rig in your garage. And you definitely can’t convert it into Tunisian dinars. Even holding crypto in a wallet is technically illegal, though enforcement focuses more on active trading and exchange services.

Financial institutions are locked in too. Banks block card payments to foreign crypto exchanges. If you try to use your debit card to buy Bitcoin, the transaction gets refused. ATMs won’t dispense crypto. No Tunisian bank will open an account for a crypto business. The rules are clear: no involvement, no exceptions.

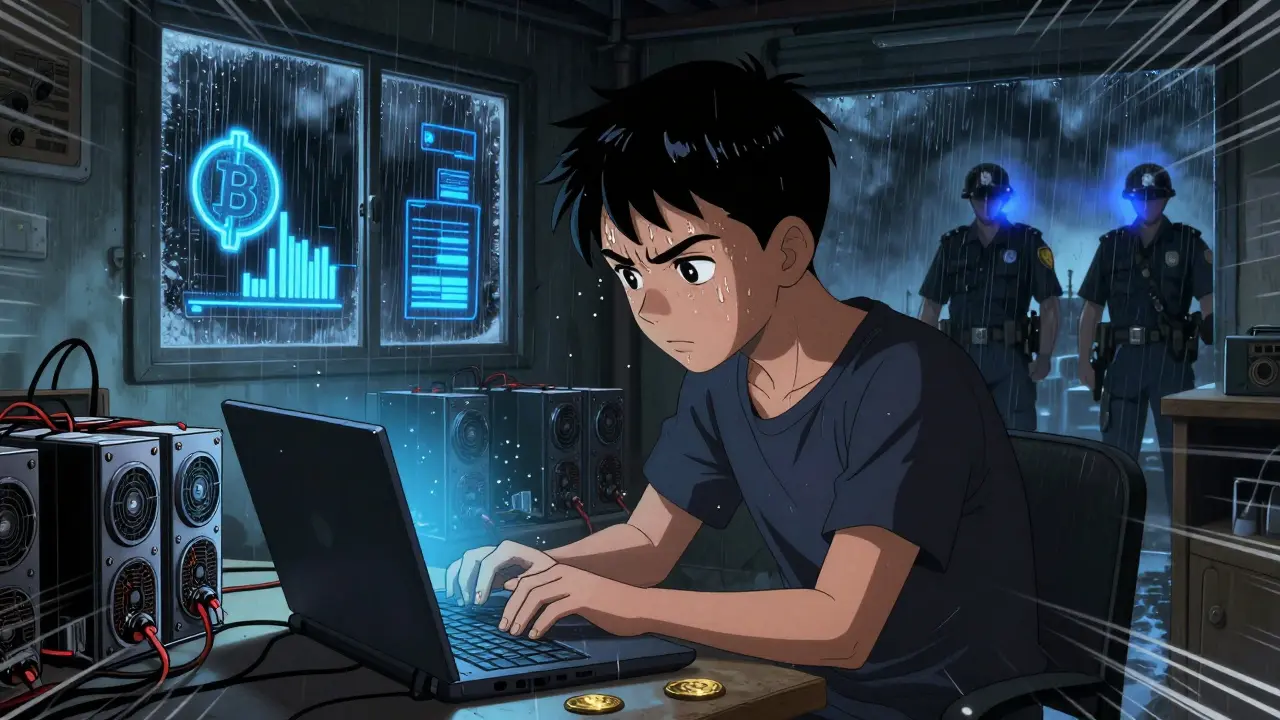

Mining is especially risky. Customs officials have seized ASIC miners at ports. If you import hardware meant for mining, it gets confiscated. And if you manage to mine anyway, selling those coins for local currency is a direct violation of the 2018 directive. The law doesn’t care if you’re doing it for fun or profit - it’s still illegal.

Why Did Tunisia Do This?

The official reason? Protecting the Tunisian dinar. In 2018, the country was already struggling with inflation, low foreign reserves, and capital flight. The BCT feared people would use crypto to move money out of the country, bypassing currency controls. They worried about money laundering, too. Crypto’s anonymity made it a potential tool for corrupt officials and criminal networks to hide funds.

It wasn’t just about crime. It was about control. Central banks rely on managing money supply, interest rates, and exchange rates. Crypto threatens that power. If people start using Bitcoin instead of dinars, the government loses its grip on the economy. In a country with weak institutions and a history of economic instability, that’s a scary prospect.

Tunisia isn’t alone. Only eight countries in the world have total crypto bans. Most others - like Germany, Singapore, or even El Salvador - chose regulation over prohibition. Tunisia picked the hard line. And for years, it held firm.

Who Gets Punished?

The penalties are harsh. Under Tunisia’s currency control laws, violating the crypto ban can mean up to five years in prison and heavy fines. Operating a crypto exchange? Jail. Marketing tokens to locals? Jail. Even helping someone buy crypto through peer-to-peer channels could land you in court.

The 2021 case of a 17-year-old student who exchanged $50 worth of Bitcoin sparked national outrage. He was jailed for a month. The story went viral. People started asking: Is this really the right way to handle technology? The case reached the cabinet. It didn’t change the law - but it cracked the silence.

Enforcement isn’t perfect. Some small-scale P2P trades still happen in private Telegram groups. People use cash or mobile money to swap crypto without leaving a digital trail. But these are underground activities. No one runs a crypto business openly. No startup advertises its token sale. The fear is real.

What About Blockchain?

Here’s the twist: Tunisia doesn’t hate blockchain. It just hates crypto.

In 2020, the BCT launched a regulatory sandbox - a controlled testing ground for fintech companies to experiment with blockchain applications. Not for Bitcoin or Ethereum. But for things like land registry digitization, supply chain tracking, and government subsidy distribution. Startups like VFunder (for creative crowdfunding) and Hydro E-Blocks (for carbon credit tracking) got approval to test their platforms inside Tunisia - as long as they didn’t touch actual cryptocurrencies.

These projects use private, permissioned blockchains. Think of them like internal ledgers controlled by the government or approved institutions. No public coins. No decentralization. Just secure, tamper-proof record-keeping. The government sees value in the technology - just not in the money.

That’s the key distinction. Tunisia is okay with blockchain as a tool. But not as a currency. It’s like allowing someone to use a calculator but banning cash.

How Does This Compare to Other Countries?

Most countries don’t ban crypto - they regulate it. Germany requires crypto exchanges to get licenses. Singapore treats crypto as property and taxes gains. El Salvador made Bitcoin legal tender. Even Vietnam and Kuwait, which restrict banks from dealing in crypto, still let individuals trade privately.

Tunisia’s ban is extreme. It’s on the same list as China, Qatar, and Egypt. But those countries are either much larger economies or have different political systems. Tunisia is a small, developing nation with limited foreign exchange. That makes its fear of capital flight more urgent - and its resistance to change more stubborn.

But the world is moving. Companies like PayPal, Microsoft, and Tesla now accept crypto payments. The Financial Action Task Force (FATF) has global rules for crypto AML compliance. Tunisia’s approach is becoming an outlier.

Is the Ban Starting to Change?

Yes - slowly.

As of 2025, a draft bill is being reviewed in parliament to decriminalize personal crypto possession. The goal? Create a licensing system for exchanges and wallet providers - not to ban crypto, but to control it. The BCT’s own Digital Tunisia 2025 plan lists blockchain for public services, signaling a shift in mindset.

What’s driving this? Two things: pressure from young Tunisians and economic reality. Thousands of young people are using crypto to send remittances, access global markets, or earn income through freelance gigs paid in crypto. They’re not waiting for permission. And with the dinar losing value, more people are turning to Bitcoin as a store of value - even if it’s illegal.

The government knows it can’t stop this forever. The question isn’t whether the ban will end - it’s how fast it will change.

What Should You Do If You’re in Tunisia?

If you’re a resident: don’t risk it. Don’t buy, trade, or mine. Don’t open a wallet. Even if enforcement seems loose, the law hasn’t changed. One bad interaction with customs or a bank could cost you your freedom.

If you’re a foreigner visiting or working in Tunisia: same rules apply. Your home country’s crypto habits don’t matter here. Tunisian law governs your actions on its soil.

If you’re a developer or entrepreneur: look at the sandbox. If you’re building blockchain tools for public services, logistics, or identity verification, there’s a path forward - just keep crypto out of it. Focus on the tech, not the tokens.

What’s Next?

Tunisia stands at a crossroads. On one side: clinging to a ban that’s increasingly unenforceable and out of step with the world. On the other: embracing regulation - allowing crypto under strict rules, protecting the dinar while letting innovation flow.

The sandbox proves they’re not anti-technology. They’re anti-uncontrolled money. If the new bill passes, Tunisia could become the first North African country to legalize crypto under a licensing system. It wouldn’t be free-market crypto. It would be state-monitored crypto. But it would be a start.

For now, the ban stands. But the cracks are showing. And in a country where 60% of the population is under 30, change is inevitable.

Is it illegal to own Bitcoin in Tunisia?

Yes. Under the 2018 Central Bank of Tunisia directive, holding cryptocurrency - even just in a wallet - is considered illegal. While enforcement often targets active trading or exchanges, possession itself violates currency control laws and can lead to penalties, including fines or imprisonment.

Can I mine cryptocurrency in Tunisia?

No. Mining cryptocurrency is banned. Importing mining hardware like ASIC rigs is illegal and subject to seizure by customs. Even if you mine locally, converting mined coins into Tunisian dinar is a direct violation of the 2018 crypto ban. Authorities have confiscated mining equipment at ports and are actively monitoring for such activity.

Can businesses in Tunisia accept crypto payments?

No. Any business that accepts cryptocurrency as payment for goods or services is breaking the law. This includes online stores, restaurants, or service providers. All transactions must be conducted in Tunisian dinars or approved foreign currencies. Violations can lead to criminal charges under the country’s currency control regulations.

Are there any legal ways to use blockchain in Tunisia?

Yes. Tunisia allows blockchain technology through its regulatory sandbox, launched in 2020. Companies can test blockchain applications for land registry, supply chain tracking, subsidy distribution, and digital identity - as long as they don’t involve actual cryptocurrencies. These are private, permissioned ledgers controlled by approved entities, not public blockchains like Bitcoin or Ethereum.

Is Tunisia planning to lift its crypto ban?

There are signs it might. As of 2025, a draft bill is under review in parliament to decriminalize personal crypto possession and introduce a licensing system for exchanges. The Central Bank of Tunisia’s Digital Tunisia 2025 initiative also supports blockchain for public services, suggesting a shift toward regulation rather than total prohibition - though no timeline has been set.

Why does Tunisia allow blockchain but not crypto?

Tunisia sees blockchain as a tool for efficiency and transparency - useful for government records, logistics, and public services. But it views cryptocurrency as a threat to monetary control. Crypto can bypass currency controls, fuel capital flight, and undermine the dinar. So they’re okay with the technology, but not with the decentralized money it enables.

What happens if I send crypto to someone in Tunisia?

Sending crypto to someone in Tunisia doesn’t make it legal for them. The recipient is still in violation of Tunisian law if they hold or use it. While the sender abroad may not be prosecuted, the recipient could face legal consequences if caught. Banks and authorities monitor suspicious transactions, and crypto transfers can trigger investigations.

Can Tunisians use crypto to send remittances?

Technically, no - it’s illegal. But some Tunisians abroad send crypto to family members as a workaround for slow, expensive traditional remittance services. These transactions happen informally, often through peer-to-peer trades using cash or mobile money. While common in practice, they remain against the law and carry legal risk for the recipient.

Comments (21)

Naman Modi

December 26, 2025 AT 12:22 PMThis is wild. Tunisia bans crypto but lets blockchain? That's like banning gasoline but allowing cars.

LOL.

chris yusunas

December 26, 2025 AT 23:24 PMI live in Lagos and we got guys mining crypto in their bedrooms with stolen power. Tunisia's ban feels like trying to stop the tide with a broom. The youth ain't waiting for permission to get free.

Tyler Porter

December 28, 2025 AT 15:34 PMI just... I don't get it. Why punish people for using technology? It's not like they're robbing banks. They're just trying to survive a broken economy.

It's heartbreaking.

Steve B

December 30, 2025 AT 00:04 AMOne must consider the structural fragility of the Tunisian state. The Central Bank’s actions, while draconian, are not without precedent in economies under existential monetary stress. One cannot simply permit decentralized alternatives without risking systemic collapse.

Sophia Wade

December 30, 2025 AT 04:05 AMIt’s fascinating how governments fear what they don’t understand. Blockchain is a ledger. Crypto is a currency. One is a tool. The other is a revolution.

Tunisia wants the tool but fears the revolution. That’s not policy - that’s denial dressed as control.

Brian Martitsch

December 31, 2025 AT 09:51 AMOf course it's illegal. You can't let peasants play with digital money. 😒

Real economies have central banks. Not some crypto bros with wallets.

vaibhav pushilkar

January 2, 2026 AT 02:14 AMActually, this is smarter than it looks. If you're a small economy with weak forex reserves, letting crypto leak out is like punching holes in a boat. Better to patch it now than sink later.

SHEFFIN ANTONY

January 3, 2026 AT 07:09 AMOh please. Tunisia thinks it's being smart? Bro, they're the only country that banned the internet but still lets people use phones. 😂

They're not protecting the dinar - they're protecting their own power.

Vyas Koduvayur

January 3, 2026 AT 14:05 PMLet me break this down with academic precision. The 2018 directive was a preemptive strike against monetary sovereignty erosion, which, according to Minsky’s financial instability hypothesis, is exacerbated by unregulated asset classes. The BCT’s sandbox model is a classic example of institutional capture - they're using blockchain to reinforce state control, not decentralize it. The irony? They’re building a more efficient surveillance state under the guise of innovation. Also, the 17-year-old kid got jailed? That’s not justice. That’s a dystopian sitcom.

Lloyd Yang

January 4, 2026 AT 10:15 AMI’ve talked to Tunisians online who are using crypto to get paid for freelance design work. They’re not trying to overthrow the economy - they’re trying to eat. This ban is crushing real people. The fact that they’re even considering a change? That’s hope. And hope is the most powerful currency out there.

Jake Mepham

January 5, 2026 AT 21:00 PMYou ever seen how fast tech spreads in Africa? Even in places with no electricity, people find a way. Tunisia’s ban is like putting a sign that says ‘No swimming’ in the ocean. The tide doesn’t care.

They’re gonna lose this battle. And when they do? They’ll wish they’d led instead of lashed out.

Craig Fraser

January 6, 2026 AT 22:15 PMI find it rather disconcerting that any nation would entertain the notion of legalising such a volatile and unregulated asset class. The very premise undermines the foundational principles of monetary policy. One cannot simply allow private actors to issue currency. It is, quite frankly, anarchy dressed in code.

Jacob Lawrenson

January 8, 2026 AT 16:56 PMTHEY’RE ABOUT TO CHANGE THE LAW?? 🤯

YES. YES. YES. FINALLY. I’ve been waiting for this since 2020. Let the youth breathe. Let them build. Let them win.

Cathy Bounchareune

January 10, 2026 AT 10:03 AMThe blockchain sandbox is genius. It’s like letting someone use a typewriter but not paper money. They want the efficiency without the chaos. Smart. But also… kinda sad? Like loving the engine but hating the road.

Jordan Renaud

January 10, 2026 AT 18:07 PMThere’s a quiet revolution happening here. Not with protests or hashtags - but with people sending crypto to their cousins in silence. Tunisia isn’t resisting change. It’s just lagging behind its own people. And that’s the most beautiful kind of rebellion.

Luke Steven

January 12, 2026 AT 17:22 PMIt’s not about crypto. It’s about who controls the story. The state wants to be the only narrator of value. Crypto says: ‘No, we’ll write our own.’

Tunisia’s fear? It’s not of technology. It’s of losing the script. And that’s why the ban will fall. Because stories written in code don’t need permission to spread.

Ellen Sales

January 14, 2026 AT 12:57 PMso they ban crypto but let blockchain?? like… okay sure. that’s like banning money but letting you use a calculator. 🤡

Shubham Singh

January 14, 2026 AT 22:19 PMThe legal framework in Tunisia is not merely restrictive - it is constitutionally sound under the imperative of monetary sovereignty. To suggest otherwise is to misunderstand the gravity of currency destabilization in a post-colonial economy. This is not oppression. It is stewardship.

Sarah Glaser

January 16, 2026 AT 10:38 AMWhat’s more dangerous: a decentralized currency or a government that can’t adapt? Tunisia’s sandbox proves they’re not anti-innovation. They’re just terrified of losing control. But control is an illusion. The world is moving - and they’re standing still.

Aaron Heaps

January 18, 2026 AT 00:54 AMSo let me get this straight. You can’t own Bitcoin but you can use blockchain to track tomatoes? 🤦♂️

That’s not policy. That’s performance art.

Tristan Bertles

January 18, 2026 AT 07:50 AMI’ve seen this before. In the 90s, people thought the internet would kill newspapers. Then it didn’t - it just changed them. Tunisia’s gonna do the same. The ban won’t last. But when it falls? It’ll be because the people refused to wait for permission to be free.